Meeting International Maritime Organization Mandates: Why E-Fuel Producers and Shippers Should Collaborate Now

August 18th 2025

The maritime sector stands at a critical juncture. Following a revised strategy adopted in July 2023, the International Maritime Organization (IMO) has set ambitious emission targets that will fundamentally reshape how ships fuel their operations. As a sector responsible for approximately three percent of global greenhouse gas (GHG) emissions, equivalent to the sixth largest emitter if it were a country, the shift towards cleaner fuels is not just an environmental imperative but a strategic necessity.

The mandate from IMO is clear: reduce total annual greenhouse gas (GHG) emissions by at least 20% with a goal of 30% by 2030, and achieve net-zero GHG emissions from international shipping by 2050, compared to 2008 levels. To reach these objectives, the IMO has established a non-binding target for zero- or near-zero (ZNZ) emission fuels to account for 5–10% of the energy used in international shipping by 2030, with a progressive increase in this share overtime.

In April 2025, during its 83rd session, the IMO’s Marine Environment Protection Committee approved the net zero framework draft as part of its mid-term measures to meet GHG reduction targets. This framework doesn’t just set targets; it creates a sophisticated economic mechanism that makes the transition to clean fuels inevitable.

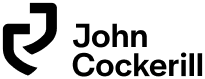

Currently, shipping relies heavily on fossil fuels such as High Sulfur Fuel Oil (HSFO), Very Low Sulfur Fuel Oil (VLSFO), and Liquid Natural Gas (LNG). But this dependence is about to become financially unsustainable and very few alternatives exist, most of which are hydrogen-based fuels as shown in the chart below. According to the Global Maritime Forum, if the target of 5-10% ZNZ fuels is achieved by 2030, it could account for 5 to 10 million tons of hydrogen.

Now that we know the importance of hydrogen fuel in meeting the IMO’s targets, let’s go into more detail about how the Net Zero Framework will drive the change to cleaner fuel use.

Figure: Compliance options for shipowners. Source : Global Maritime Forum

IMO Net Zero Framework: A Three-Part System Starting in 2027

The IMO Net Zero Framework operates through a comprehensive three-part system designed to reduce carbon intensity and incentivize the adoption of green fuels:

1. GHG Fuel Intensity (GFI) Targets

Starting in 2028, international shipping vessels of 5,000 gross tonnage and above must meet yearly well-to-wake GHG fuel intensity targets based on 2008 levels, with an initial GFI set at 93.3 gCO₂eq/MJ. The framework establishes two annual compliance trajectories: a Direct Compliance target and a Base target.

Ships’ annual GFI is calculated based on the weighted average GHG intensity of all fuels used onboard in a given calendar year, including fuel oil, shore power, and zero-emission sources like wind or solar.

2. Two-Tier Penalty System

For ships that miss their GFI targets, a two-tier penalty system kicks in, requiring the purchase of Remedial Units to balance their deficit:

- Tier 1 compliance deficit applies when a ship’s attained annual GFI falls between the direct compliance target and base target. This deficit requires Remedial Units priced at $100 per tonne of CO2eq.

- Tier 2 compliance deficit applies when a ship’s attained annual GFI exceeds the base target. This more significant deficit requires Remedial Units priced at $380 per tonne of CO2eq.

Note: These prices are initial rates for 2028-2030 with projections suggesting potential increases to $450 per tonne of CO2e in 2031 and $600 per tonne of CO2e by 2034 based on the UCL assumptions.

3. Carbon Market & Incentive Mechanisms

The framework creates a maritime carbon market with two key components:

- Surplus Unit Trading System: Ships that outperform their targets receive Surplus Units representing their positive compliance balance. These can be traded to other ships to help balance Tier 2 compliance deficits, banked for up to two years, or voluntarily cancelled as a mitigation contribution.

- IMO Net-Zero Fund: This fund, administered by the Organization’s Secretary-General, receives GHG emissions pricing contributions from ships and redistributes revenue. A significant portion specifically rewards the uptake of zero or near zero emission fuels. ZNZs are currently defined as having a GFI not greater than 19.0 gCO2eq/MJ until December 31, 2034, after which the threshold drops to 14.0 gCO2eq/MJ. Over $10 billion in penalties is expected to be generated in Year 1 and allocated to subsidize very low emission fuel users as well as guaranteeing the financing of a just and equitable transition in the least developed countries and small island developing states.

Understanding the Framework: A Clear Path to Either Penalties or Compliance Rewards

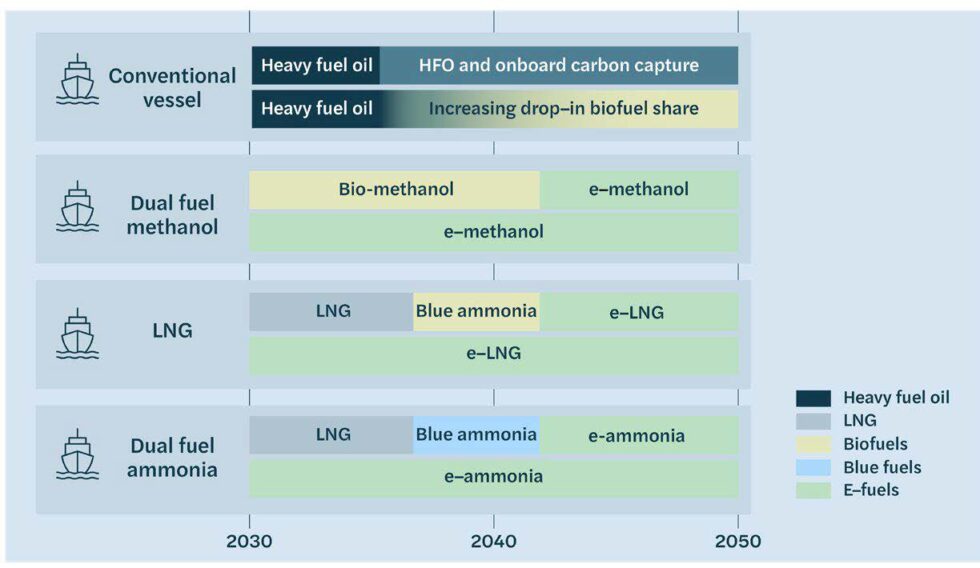

When you consider these incentive mechanisms together, the framework becomes straightforward to visualize. The graph below has a vertical axis that shows the percentage of IMO reduction targets starting from the 2008 reference GFI of 93.3 gCO2e/MJ, which represents 100% at the top, and the horizontal axis spans years 2028 to 2035.

There are two primary positions for the shipowner to hold within the graph: either in penalty, or in compliance. The base target for emissions starts at the top of the dark blue zone, with the compliance target being the bottom of the blue zone.

GFI values: 91.7 gCO2eq/MJ for HSFO & VLSFO; 82.9 gCO2eq/MJ for LNG; 28.8 gCO2eq/MJ for Biodiesel; 16.1 for bio-methanol; 4.8 gCO2eq/MJ e-methanol; 3.5 gCO2eq/MJ e-ammonia (source: BNEF)

Penalty positions: GFI falling in either tier 2 (yellow) or tier 1 (dark blue) zones

- Above the base target in the tier 2 (yellow) zone

- Ships with GHG fuel intensity exceeding the base target must pay:

- Remedial Unit 2 rate at $380/tonne CO₂e for the excess over the base target (or cover it by purchasing Surplus Units), and

- Remedial Unit 1 rate at $100/tonne CO₂e for the shortfall relative to the direct compliance target.

- Ships with GHG fuel intensity exceeding the base target must pay:

- Below the base target and above the direct compliance target in the tier 1 (dark blue) zone

- Ships with GHG fuel intensity exceeding the direct compliance target must pay:

- Remedial Unit 1 rate at $100/tonne CO₂e to cover their gap to the direct compliance target. They cannot use surplus units in this position.

- Ships with GHG fuel intensity exceeding the direct compliance target must pay:

Compliance positions: GFI falling into the compliant zone target (light blue) and the fully rewarding (light green) zones

- Below the direct compliance target (light blue zone)

- These vessels generate surplus units, which can be traded to other ships, banked for up to two years, or cancelled voluntarily.

- Below the ZNZ threshold in the rewarding zone (light green zone)

- Fuels qualifying as Zero or Near Zero Emission (ZNZ) fuels are eligible for financial support through the Net Zero Fund

This regulatory framework fundamentally changes the economics of marine fuel. When you factor in penalties, fossil fuel prices will increase significantly, creating inevitable pressure on the shipping industry to transition to alternative fuels like e ammonia and e-methanol. The question isn’t whether this transition will happen—it’s how quickly your operation can adapt to capitalize on the changing landscape.

The Economics Tell the Story: E-Fuels Will Deliver Cost Savings

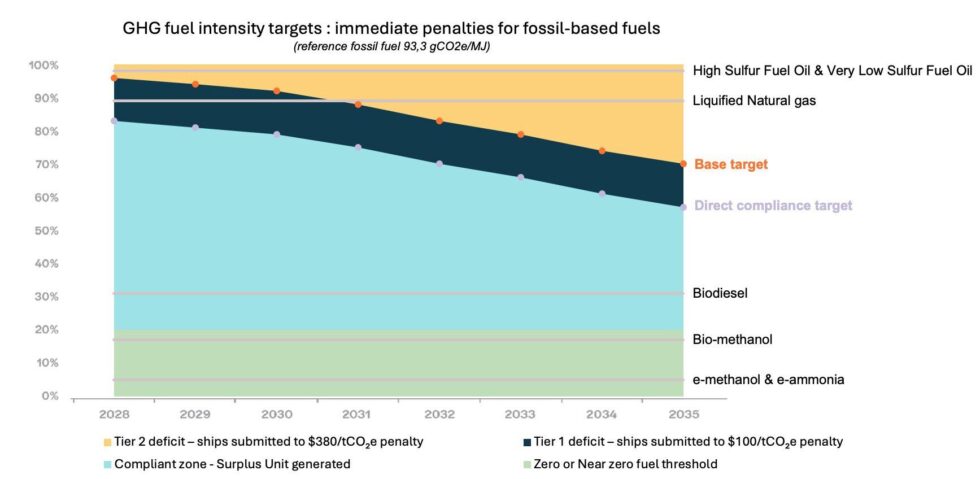

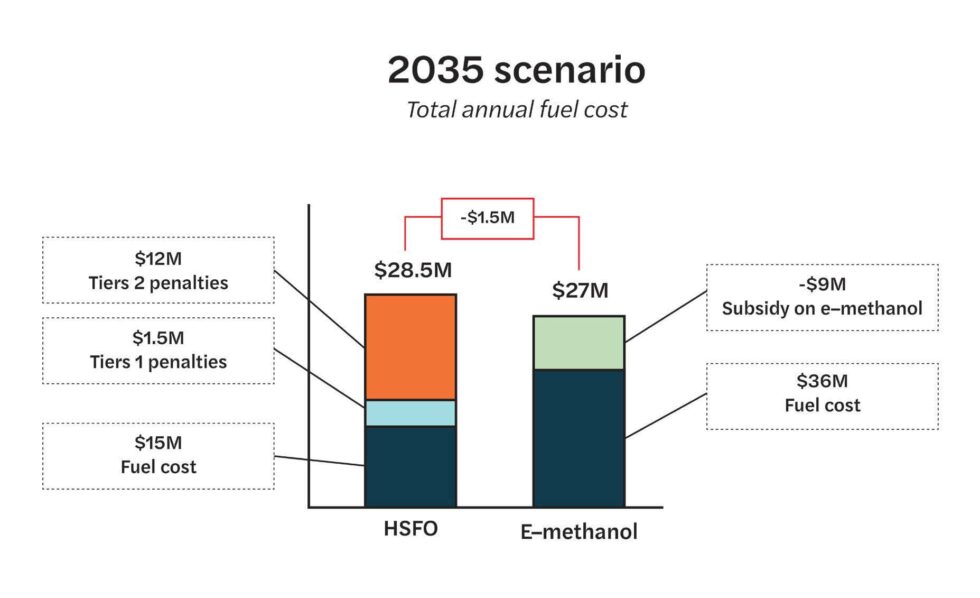

To understand the financial impact, let’s examine a hypothetical example: a 8,000 TEU container vessel with annual fuel consumption of 30,000 tonnes. We’ll compare 1) HSFO at $500/t SPOT price with; 2) e-methanol at $1,200/t based on BNEF assumptions for 2030 alongside a $300/t subsidy on ZNZ fuels.

For the sake of simplicity, this comparison assumes identical fuel consumption volumes across both scenarios, without accounting for dual-fuel strategies, technical factors such as energy density, engine efficiency, or vessel speed.

In 2030, fossil fuel (HSFO) still appears more economically attractive despite penalties:

The price increases by 28% reaching 19.3M due to the penalties, while the annual premium cost for e-methanol in 2030 is still nearly $8M.

While in the very short term, HSFO appears to be the winning strategy, but by 2035, the economics shift dramatically, as seen on the next page.

In this scenario, the cost of HSFO nearly doubles reaching $28.5M of total fuel cost compared to the $27M in fuel costs of e methanol. Now e-methanol becomes the more attractive option, providing a cost saving of $1.5M compared to HSFO with penalties. This demonstrates the accelerating financial pressure to adopt cleaner fuels as IMO targets become more stringent.

In conclusion, shipowners must take a long-term view when renewing their fleet, given that vessels typically remain in operation for 20 to 30 years and new build deliveries take from two to three years. Selecting a ship today requires anticipating future regulatory and economic pressures, including carbon pricing and fuel-related penalties introduced by the IMO and regional frameworks like the EU ETS in Europe. Ordering a vessel that relies solely on fossil fuels exposes operators to significant risks: in the hypothetical case above we see that within just 5 years, conventional fuels could become more expensive than e-methanol, making operations less competitive. This could leave owners with two options: either run an increasingly costly ship for another 15–25 years, or decommission it prematurely, turning it into a stranded asset. This long term strategy seems to be already adopted by ship owners. Indeed, according to BloombergNEF’s 2025 Marine Fuel Outlook, 338 methanol-fueled vessels are currently on order showing a strong signal of the industry’s growing confidence in this low-carbon alternative.

Pressurized Electrolyzers: The Key to Cost-Competitive E-fuels

The long-term outlook for green hydrogen-derived fuels is positive, with large-scale production expected to drive down costs as market demand builds. The production of e-fuels such as e-ammonia and e-methanol depends heavily on efficient green hydrogen production.

Consider the pressure requirements: the Haber-Bosch process for producing e-ammonia requires high-pressure hydrogen between 100 and 450 bar, while direct hydrogenation of CO2 to produce e-methanol operates at pressures between 70 and 80 bar. This highlights the critical importance of pressurized, continuous, and largescale hydrogen production for maritime e-fuel production.

John Cockerill Hydrogen specializes in pressurized alkaline electrolyzers with the aim to deliver a reliable and cost-effective supply of green hydrogen at scale. These advantages will be critical in making alternative fuels not only environmentally compliant but also economically competitive as the maritime industry transitions to meet IMO mandates.

The Path Forward

The IMO Net Zero Framework represents a groundbreaking shift towards decarbonizing international shipping, establishing legally binding targets and introducing a comprehensive market-based mechanism with penalties and incentives. As demonstrated by the projected costs for 2030 and 2035, the financial imperative to transition from fossil fuels to zero and near-zero emission alternatives like e-methanol will rapidly intensify.

The framework provides a clear market signal, pushing the maritime sector towards innovative fuel solutions. The next crucial step is a second vote expected at the Marine Environment Protection Committee session in October 2025. With 79% approval in the initial vote, the framework is highly anticipated to pass, solidifying it as a cornerstone of the maritime industry’s green transition.

The journey towards net-zero emissions is complex, but the path is becoming clearer. Shipowners and e-fuel producers must collaborate now to navigate this transition effectively—and the technology to make it economically viable already exists.

Ready to learn more about the cost savings potential of using pressurized alkaline electrolyzers for e-fuel production? Contact us today to discover how we can support your journey to meeting IMO compliance.